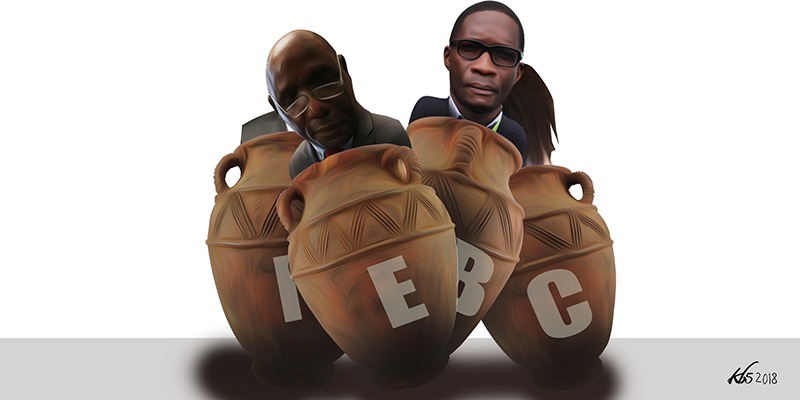

A decision last week by the plenary of the IEBC to send chief executive officer Ezra Chiloba on forced leave to pave way for a 90-day audit by the Kenya National Audit Office blasted open the simmering rivalries that have dogged this Commission’s tenure since it came to office in January 2017. As accusations and counter-accusations fly, it is now apparent that conflicts of interests over procurement tenders, rather than political factionalism or even the struggle to establish the truth of the August elections last year, will be the IEBC’s comeuppance.

Chiloba’s suspension triggered the resignations of commissioners Connie Nkatha Maina, who was the vice-chair, Margaret Mwachanya and Paul Kurgat. The trio’s departure, in addition to the dramatic resignation of commissioner Roselyn Akombe ahead of the October 26, 2017 presidential election re-run, denies the seven-member commission the necessary quorum of four to convene. Simply put, the Commission is paralysed.

Paralysis at the Commission will, among other things, throw a spanner in the works of the rumoured referendum on a constitutional amendment to replace the current presidential system with a parliamentary one – supposedly the end-game of the March 9 handshake between Uhuru Kenyatta and Raila Odinga.

While Ruto may have been the puppet-master who engineered the commissioners’ resignations – the influence of Ruto’s faction of the Jubilee party on the Commission has long been whispered – ostensibly to protect both his current position and his 2022 presidential ambitions, two other important casualties could well go down with a moribund IEBC: the truth of the August 2017 elections, and serious attempts at long-term electoral reform. These things, as we shall see, are not unrelated.

But first, to the ongoing drama at the Commission. Chiloba first found himself in trouble with his commissioners last year, in the messy aftermath of the presidential elections annulment, as the Commission prepared for a fresh poll. It is well worth noting that his latest suspension arises from some of the questions Chebukati raised in his leaked September 1, 2017 memo. Investigating five procurement tenders, the IEBC’s five-member Audit and Risk Committee found that Chiloba as the Commission’s chief accounting officer, committed serious violations of the Public Procurement Act in at least two instances.

While Ruto may have been the puppet-master who engineered the commissioners’ resignations – the influence of Ruto’s faction of the Jubilee party on the Commission has long been whispered – ostensibly to protect both his current position and his 2022 presidential ambitions, two other important casualties could well go down with a moribund IEBC: the truth of the August 2017 elections, and serious attempts at long-term electoral reform.

The first involved a Ksh 275 million contract with Oracle Technology Systems (Kenya) Ltd to provide election database solutions. The Audit Committee noted that: “There was no contract for provision of Oracle Database and Security Solution…between IEBC and Oracle Technology Systems (Kenya) Ltd drawn by [the Commission’s Directorate of Legal and Public Affairs] and signed by IEBC and Oracle Representatives. Instead, signed ordering documents drawn by Oracle…were provided [as evidence of a contract].”

Observing earlier that there had been no tender award notification, the committee described this situation as ‘High Risk’. More seriously, noted the committee, full implementation of the Oracle database system was only finalised on February 14, 2018, six months after the elections.

The second, once again, is tech-related: a Ksh 913 million contract, with Airtel Kenya Ltd, for the delivery of 1,553 Thuraya satellite modems – to be used for results transmission in remote areas. Signed just three weeks before the August 8 elections, in its acceptance letter, Airtel Kenya indicated that it could only deliver 1,000 modems in time. “Nonetheless,” notes the committee in the report, “the Commission proceeded to execute an agreement for 1,553 devices. Inquire why the Commission purchased 553 devices – despite the correspondence.”

The remaining 553 devices arrived two-and-a-half weeks after the elections.

IEBC chairman Wafula Chebukati and Dr Akombe lost a plenary battle to force Chiloba out of the commission following the Supreme Court’s annulment of the August 8 presidential election. At the time, attempts to obtain some answers from Chiloba for the disastrous August elections were fought off by Deputy President William Ruto, who claimed in a television interview that all the answers to the questions being raised had been provided. When Chiloba’s suspension looked irreversible last week, we are reliably informed, the three resigning commissioners consulted Ruto before taking the leap.

With Chiloba’s suspension now underway and the National Audit Office stepping in, the corruption investigation will only complicate the mystery around the 2017 elections – and further delay any efforts to fix the IEBC. Disputed elections in Kenya have nurtured a culture of rewarding suspected wrongdoers instead of punishing them. The Samuel Kivuitu-led Electoral Commission of Kenya, which presided over the disputed 2007 elections, was booted out of office at a cost of Sh68 million. Its successor, the Isaack Hassan-led Independent Electoral and Boundaries Commission received Sh315 million to leave office a year early.

Law scholar Muthomi Thiankolu observes that electoral malpractice does not occur by itself; that there are human beings behind it. “We have, since 1962, ignored them through legal sophistry. The courts’ refusal to personally sanction malpractice gives life to this perverse incentive.”

While the Kriegler Commission recommended root-and-branch electoral reforms after the 2007 elections debacle, the fact that the IEBC’s report on the 2013 elections was rejected by Bunge – there is to this day no comprehensive accounting of what happened in 2013 – suggests that even the piecemeal reforms eventually instituted under Kriegler were sabotaged by Executive capture. Accountability for electoral malfeasance remains Kenya’s political bugbear. Ironically, neither a Jubilee-run parliament, nor a demand for a popular referendum (á la the opposition’s Okoa Kenya initiative) submitted to a captured IEBC is likely to succeed.

With the resignation of the commissioners at the IEBC, a referendum appears out of the question, given the history that the opposition Coalition for Reforms and Democracy had with the Okoa Kenya (Save Kenya) initiative. After a year of public mobilization, the IEBC ruled that the referendum bill was dead on arrival because the movement had not collected the requisite one million signatures to warrant its presentation to the county assemblies for a vote.

CORD resorted to mass action outside the IEBC offices that ended in a Sh315 million buyout of the commissioner’s contract remainders, achieving the replacement of new commissioners seven months to the election.

The Audit Committee noted that: “There was no contract for provision of Oracle Database and Security Solution…between IEBC and Oracle Technology Systems (Kenya) Ltd drawn by [the Commission’s Directorate of Legal and Public Affairs] and signed by IEBC and Oracle Representatives. Instead, signed ordering documents drawn by Oracle…were provided [as evidence of a contract].”

With both the parliamentary and referendum routes to electoral justice closing, a managerial housecleaning may seem an acceptable compromise, but there are few guarantees that, as happened during the bipartisan Windsor Reform exercise, that it will not be scuttled by an Executive desperate to cling to power. Senate minority leader James Orengo and National Assembly majority leader Aden Duale appear to agree that the whole IEBC team needs to go, but none has reckoned with how long their replacements will be in coming. More dangerously, it will be harking back to the tried and failed methods of piecemeal changes to the electoral management body attempted over time.

Demands for political dialogue have significantly featured on the agenda electoral justice questions, which would entail acknowledgment of wrongdoing, punishment for election crimes, restitution for harms suffered and guarantees of non-repetition following similar disputes in the 2007, 2013 and 2017 elections.

Parliament, which has been riven by disputes over the unresolved August 2017 presidential election, was clearly doing the bidding of State House when it passed amendments to the Elections Act in the run-up to the repeat presidential election in October 2017. The amendments, which were aimed at weakening Wafula Chebukati’s authority among the commissioners, were struck down by the High Court as unconstitutional early this month. A captured Commission had by that time already unanimously endorsed Uhuru Kenyatta’s victory.

With a majority of 268 seats to NASA’s 127, Jubilee’s dominance in Parliament is not only guaranteed, it is likely to be bolstered if the trend of abortive election petitions continues. Consequently, any possibility that Bunge could become the site of genuine electoral reform is closed for the foreseeable future.

By mid February 2018 when a summary of court decisions in 244 petitions challenging the results of various races in the August 8, 2017 polls was published, Parliament had been closed off as a site of reform, turning the dream of electoral justice into a political chimera.

Over half of the 388 petitions challenging various elections had floundered for a variety of reasons — none of which had anything to do with what had happened at the ballot: Fourteen petitions were withdrawn before trial; another 14 dismissed for being filed out of time, 10 thrown out because the case papers were not served on victors; nine failed to take off because security for costs was not paid; and two could not proceed because the petitioner or their lawyers were not in court. One election winner died.

A paltry 14 petitions against the election of Members of the National Assembly and one against a governor had succeeded. Not only were the numbers in the Senate going to hold, with the Jubilee Party enjoying a majority, but the 14 by-elections for National Assembly seats posed the risk of reducing the Opposition minority from its 127.

If an incumbent has a direct interest in capturing the electoral management body to manipulate the results, then the EMB is also under pressure from crony oligarchs interested in profiting from procurement deals. Furthermore, the absence of formally funded political parties has created a gap for these very oligarchs to take control of and shape political movements. Elections in Kenya thus become a democracy auction, in which the highest bidder bags the prize.

Despite the enactment of the Political Parties Act in 2012, which provides that 0.3 per cent of all revenue should go to the Political Parties Fund to resources parties, Treasury has only allocated 0.03 per cent of revenue each year. Last year, the High Court agreed that the Orange Democratic Movement should have been paid the Sh4.1 billion owed to it from the fund, but ruled that claiming it late put the party at fault.

Nothing illustrates the desperation around the award of specific tenders and contracts more graphically than the last-minute litigation by the IEBC against the cancellation of the Sh2.5 billion ballot-printing contract to Al Ghurair of the United Arab Emirates. After contesting every court decision over eight months, the IEBC prevailed because the Court of Appeal realized that the country had run out of time to appoint a new supplier for the ballot materials.

The 2010 referendum on the draft constitution, considered one of the cleanest electoral events in recent history, gave birth to the Chickengate scandal, in which British printer Smith & Ouzman padded the cost of ballot papers in order to raise bribes for Kenyan officials awarding the tender. The British Crown Court fined the company Sh52 million and jailed its director. For its part, Kenya received the Sh52 million fine and spent it on ambulances. Three people were charged in connection with receiving bribes last year, a month to the elections.

If an incumbent has a direct interest in capturing the electoral management body to manipulate the results, then the EMB is also under pressure from crony oligarchs interested in profiting from procurement deals. Furthermore, the absence of formally funded political parties has created a gap for these very oligarchs to take control of and shape political movements. Elections in Kenya thus become a democracy auction…

The sheer scale of electoral operations has created a micro economy out of elections in Kenya, attracting a gaggle of sleaze-balls into election management. Questions have been raised over the award of Sh2.4 billion technology contracts to OT Morpho, the firm at the centre of the crisis involving the presidential election results, as well as the multi-million shilling supply of satellite phones for results transmission redundancy. Additionally, IEBC has been forking out billions of shillings in legal fees despite having a fully staffed legal department.

Instructively, criminal cases against former IEBC chief executive officer James Oswago, his deputy Wilson Shollei and managers Edward Karisa and Willy Kamanga over the purchase of Sh1.3 billion of biometric voter identification kits are still in court, six years after the Supreme Court recommended investigation and prosecution.

From the 2017 elections, a handful of election officials have been charged with petty offences relating to altering results in 2017, but accountability for major electoral breaches still remain the stuff of the political circuit.

Lucre is the reward for election managers to look the other way as politicians steal the vote. Still, with all its election problems, Kenya is already so far ahead of the pack in the region that, not unlike its steeplechase runners, it can afford to slow down the pace to allow those behind to catch up.

As it is, elections cannot be challenged in Tanzania once results are announced; in Uganda, courts can find elections flawed and still uphold the results. In Rwanda and Burundi, it never gets that serious. Unfortunately, the failure to debate and tackle questions of electoral justice loads them with grievances about exclusion of ethnicities, constructs narratives of marginalization and makes for less stable societies.

Kenya has unsuccessfully experimented with a representative commission bringing together political parties and a professional outfit, to no avail. Like the male praying mantis approaches an act of mating with the knowledge of its inevitable fate, so too have electoral commissions in Kenya come to conduct polls knowing that their heads will be shortly bitten off.