It is common knowledge that coal has significant impacts on the environment, human health and livelihoods, and oceans and marine life yet Amu Power, the entity behind the proposed 1,050 MW Lamu Coal Plant, is minimising these risks and arguing that the plant is necessary on economic grounds. Their arguments do not hold up under scrutiny.

Amu Power makes three claims about the plant: 1) that it will provide cheap electricity – their marketing states that the plant will provide electricity at KSh7.8/kWh; 2) that it will create employment opportunities for Kenyans; and 3) that inexpensive electricity from the coal plant will spur manufacturing in Kenya and transform the country into a middle-income economy by 2030.

In January 2021 the Kenya Power and Lighting Company (KPLC) sold electricity to domestic consumers at KSh24.06/kWh. In comparison, the KSh7.8/kWh promised by Amu Power looks great. But that is what KPLC, not its customers, will pay. This amount is a component of only one line item, known as the Fuel Cost Charge (FCC), of the total cost per kilowatt hour that KPLC charges consumers.

In January 2020, the Fuel Cost Charge was KSh2.58/kWh for residential and commercial consumers. This means that the electricity Amu Power is offering is at least three times more expensive than what KPLC is currently paying.

That in itself should put an end to any economic argument for the Lamu Coal Plant. However, and as we shall see, the true costs of this plant are much higher.

1) Claim: Coal as a cheap source of power

Three inputs to the cost-of-electricity equation demonstrate that power from the plant will always cost more than KSh7.8/kWh and will therefore never be competitive against renewable resources: 1) price of coal; 2) capacity factor; and 3) hidden costs.

Price of coal: When Amu Power sold the idea of the Lamu Coal Plant to Kenya in 2014, their plan was to import coal from South Africa because there will be no coal available in Kenya to fuel the plant in the foreseeable future.

Amu Power’s claim that electricity from the plant would cost KSh7.8/kWh was based on a coal price of US$50/metric tonne. However, even at the time they made the claim, the average price of South African coal delivered to Kenya was already 50 per cent higher — over US$77.3/metric tonne. Coal prices fluctuate and so will the cost of power from a coal plant. At least once in the past six years, South African coal has been higher than US$106/metric tonne — more than twice what Amu Power quoted to convince the Kenyan government to give the company a permit.

The Power Purchase Agreement (PPA) between Amu Power and KPLC provides formulae to calculate the cost of electricity from the plant. Inputting a coal price of US$77.3/metric tonne — with all other of the proponent’s assumptions holding steady — increases the cost of electricity from the plant to KSh8.98/kWh. At a coal price of US$106/metric tonne, it would go up to KSh10.21/kWh.

In 2017, the Ministry of Energy and Petroleum (MoEP) projected the price of coal will be USD$108/tonne in 2040. That would make the cost of electricity from the Lamu Coal Plant at least KSh10.27/kWh, almost four times the FCC today.

But accounting for a more accurate cost of coal does not bring to an end the adjustments necessary to Amu Power’s fantasy pricing. There are two other factors that must be taken into account to arrive at a more realistic price for the electricity from the proposed coal-fired plant.

But accounting for a more accurate cost of coal does not bring to an end the adjustments necessary to Amu Power’s fantasy pricing. There are two other factors that must be taken into account to arrive at a more realistic price for the electricity from the proposed coal-fired plant.

2) Capacity Factor: This is the actual amount of electricity generated by a plant as compared to the maximum amount it can produce. Amu Power’s projected price of KSh7.8/kWh is not only based on an inaccurate price of coal, but it is also based on the assumption that the plant will run at 85 per cent capacity. For context, the global average utilisation for a coal-fired plant in 2019 was 54 per cent.

According to Amu Power, at 85 per cent capacity the Lamu Coal Plant would generate 7,305 gigawatt hours of electricity each year, which would enable it to meet the inflated demand forecasts presented in the MoEP’s 2011 Least Cost Power Development Plan. Based on more realistic demand forecast scenarios, in 2017 the Ministry calculated that the plant would generate – at most – only a third of Amu Power’s pledge. More damaging, in 2020, the MoEP calculated that in a fixed-case scenario the Lamu Coal Plant would operate at 2.8 per cent in 2030, at 4.6 per cent in 2035, and at 14.4 per cent in 2040. In an optimized, best-case scenario, the MoEP calculated that the plant would reach an operating capacity of only 26.2 per cent in 2040 (two-thirds into its lifespan). Therefore, based on the MoEP’s own calculations, Kenya does not need a 1,050 Mw coal plant.

The PPA commits ratepayers to paying Amu Power KSh37 billion annually for each of the 25 years the plant is expected to operate – a total of KSh900 billion. This capacity payment – approximately KSh100 million every single day – will be paid regardless of how much electricity the plant produces. If the plant is operating, the annual capacity payment is amortised and included in the price we pay per kWh for electricity. That is significant because the higher the capacity factor, the less we pay per kWh.

The MoEP’s 2020 calculation that in an optimised, best-case scenario, the plant will operate at 26.2 per cent capacity – and not the 85 per cent capacity that Amu Power needs to make their electricity even marginally cost-competitive with geothermal and wind – is thus significant because a change in the capacity factor has more of an impact on the price of electricity from the plant than a change in the price of coal.

Coal-fired electricity from the proposed Lamu Coal Plant will be two to ten times more expensive than from current sources of generation.

If the plant operates at 26.2 per cent, the cost of electricity will be KSh19/kWh (using Amu Power’s claim of US$50/tonne). But if we also include a more realistic price of coal (US$77.3/tonne – the actual price in 2014), electricity from the plant would cost KSh20/kWh. Using the most recent highest price of South African coal (US$106/tonne), the cost would be KSh21/kWh, nearly eight times what we are paying now.

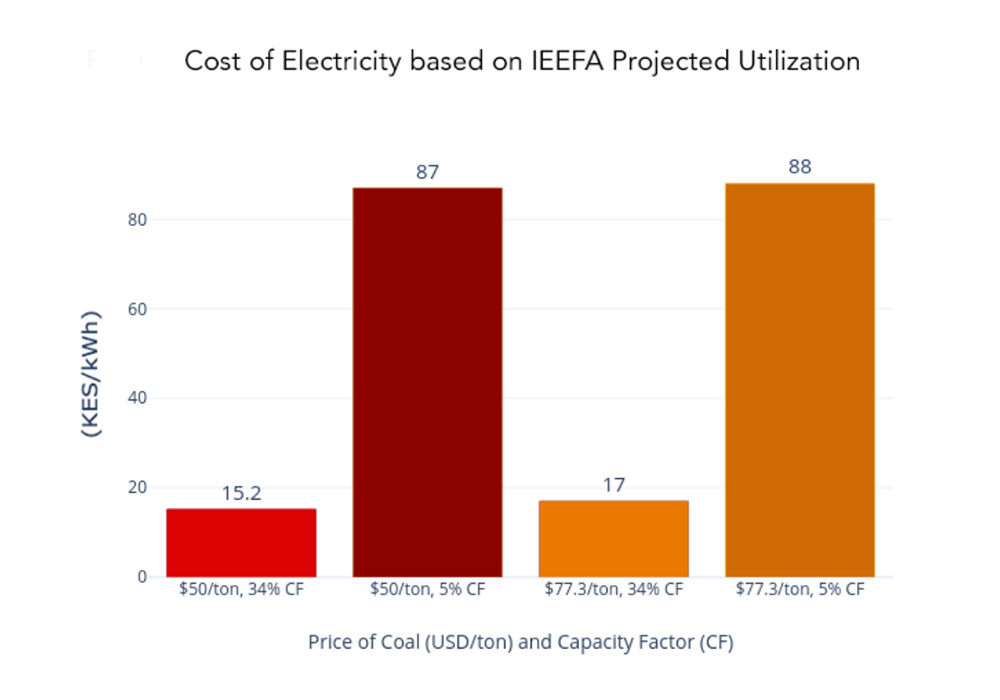

When the Institute of Energy Economics and Financial Analysis (IEEFA) analysed the 2017 MoEP data, it found that the plant would more likely run at between 5 per cent and 34 per cent capacity. If the plant runs at 5 per cent capacity, the price of electricity increases by KSh79.3/kWh, and at 34 per cent capacity, it goes up by KSh7.4/kWh, for a price range of between KSh15.2 and KSh87.1/kWh (assumming coal were miraculously available at US$50/tonne). If coal were at US$77.3/metric tonne, the price of the electricity generated by the Lamu Coal Plant would be between KSh17/kWh (at 34 per cent capacity) and KSh88/kWh (at 5 per cent capacity).

When the Institute of Energy Economics and Financial Analysis (IEEFA) analysed the 2017 MoEP data, it found that the plant would more likely run at between 5 per cent and 34 per cent capacity. If the plant runs at 5 per cent capacity, the price of electricity increases by KSh79.3/kWh, and at 34 per cent capacity, it goes up by KSh7.4/kWh, for a price range of between KSh15.2 and KSh87.1/kWh (assumming coal were miraculously available at US$50/tonne). If coal were at US$77.3/metric tonne, the price of the electricity generated by the Lamu Coal Plant would be between KSh17/kWh (at 34 per cent capacity) and KSh88/kWh (at 5 per cent capacity).

Plotting the price of electricity under the MoEP fixed-case scenarios, things look even worse. At 2.8 per cent capacity – assuming US$$77.3/tonne of coal – electricity from the plant would be KSh154/kWh, at 4.6 per cent it is KSh95/kWh, and at 14.4 per cent it is KSh33/kWh.

Plotting the price of electricity under the MoEP fixed-case scenarios, things look even worse. At 2.8 per cent capacity – assuming US$$77.3/tonne of coal – electricity from the plant would be KSh154/kWh, at 4.6 per cent it is KSh95/kWh, and at 14.4 per cent it is KSh33/kWh.

This is not looking good for Kenyans. But there are more adjustments needed to generate a more realistic price of electricity from the Lamu Coal Plant.

3) Hidden Costs: There are two hidden cost centres that make the economics of the plant even worse for Kenyans – the Power Purchase Agreement itself and unaccounted-for construction costs.

The PPA and Letter of Support signed by the Kenyan government guarantee that Amu Power will be paid KSh37 billion annually for providing a plant to generate electricity – even if the plant does not produce a single kilowatt. These two documents guarantee that the Government of Kenya will pay Amu Power if the plant ceases to operate due to a political event, a change in the law, or a force majeure event including acts of God, epidemics, plagues, terrorism, labour disputes, public unrest, or piracy.

If the Government of Kenya is on the hook for the bill, this means that Kenyans will need to pay extra to ensure that Amu Power makes its profits for the remainder of the 25 years. Based on the amount of electricity consumed annually in Kenya in 2018 and 2019, paying the KSh37 billion to Amu Power via KPLC would increase the price of electricity by KSh4.6/kWh for 25 years. We would not be getting even a kilowatt of electricity for this tariff while Amu Power owners would be doing nothing and still making billions off the backs of Kenyans.

The other hidden cost is that of construction. In order for the electricity generated in Lamu to be available on the national grid, a transmission line must be built to transport the electricity from Lamu to Nairobi and in order for coal to get from the proposed mine in Kitui, a railway line must be built from Kitui to Lamu. Neither of these costs is included in the price of the plant.

The latest Least Cost Power Development Plan 2020-2040 estimated that the transmission line will cost approximately KSh55.9 billion. The Environmental and Social Impact Assessment (ESIA) estimates that the railway line will cost KSh290 billion. In addition, prior to coal being sourced from Kitui, a 15 km conveyor belt must be built to bring the coal that is delivered to the port at Kililana in Lamu to the site of the coal plant at Kwasasi. The ESIA does not provide a cost for the conveyor belt.

Amu Power owners would be doing nothing and still making billions off the backs of Kenyans.

Together, the railway and transmission lines add at least an additional KSh345.9 billion to the cost of the plant. Because the costs for transmission lines and railroads were not included in the formula calculating the price of electricity from the Lamu Coal Plant that was disclosed in the PPA, we do not know if our electricity bills will increase per kWh to cover the cost of these necessary components of the plant or if, instead, Kenyans will pay for this via taxes. A rough calculation using the formula for electricity pricing shows that if KSh345.9 billion is repaid over 25 years via our utility bills and the plant is operating at 26.2 per cent capacity (the MoEP’s best-case scenario), the cost will increase by an additional KSh6/kWh.

Looking at the reality of the price of coal inputs, plant utilisation, and the full cost of construction, it is clear that the Lamu Coal Plant cannot possibly generate electricity for KSh7.8/kWh. It is much more likely that the electricity from the coal plant will cost KSh26/kWh assuming a more realistic cost of coal (US$77.3/tonne), with the plant running at 26.2 per cent capacity as predicted by the MoEP, and that rail and transmission costs are amortised over the 26.2 per cent capacity factor.

It is possible for the cost to be as low as KSh15/kWh if the cost of coal is US$77.3/tonne and the plant operates at the international average of 54 per cent utilisation, with rail and transmission costs amortised over 54 per cent capacity factor. Or it could be as high as KSh213/kWh if coal costs US$100/tonne, the plant operates at the 2.8 per cent utilisation rate in the MoEP’s lowest fixed-case scenario, and rail and transmission costs are amortised over the 2.8 per cent capacity factor.

2) Claim: Coal as an employment creator

2) Claim: Coal as an employment creator

The Lamu Coal Plant Environmental Impact Assessment states that the plant will employ between 2,000 and 3,000 people during the 42-month construction period and 400 people during its 25 years of operation.

While on the face of it this seems like a good thing for Kenya, it is important to look closely at the jobs lost due to the construction and operation of the plant, the jobs gained, and who gets these jobs.

To explore this, we can look at the two main industries in Lamu, tourism and fishing. Pre-COVID data found that tourism injects over Ksh2 billion per year into Lamu’s economy and pays over KSh500 million in taxes each year. This sector directly employs more than 3,000 locals in hotels and restaurants and several thousand more as boat operators for the visiting tourists, and tourist guides.

Particulate emissions from the coal plant will result in significant damage to the historic buildings and structures in Lamu Old Town, a UNESCO World Heritage Site. The effluent emissions will cause ocean temperatures to rise, destroying the coral reefs and increasing toxicity which will make it unsafe for tourists and locals to swim, snorkel, and dive. With the plant in operation, Lamu will no longer be a pristine and unique tourist attraction.

Most significant is the impact of the smoke from the stacks at the plant. The Kaskazi winds blow from October through May, when the island welcomes 80 per cent of its tourists. The winds blow from the northeast – the direction of the plant – and across the archipelago. This air will carry the toxic, noxious emissions from the plant to Lamu as well as cause haze pollution that will reduce visibility of the shoreline so beloved of tourists and locals. The Lamu Tourism Association expects that business will drop by at least 80 per cent due to this pollution. As such, the industry expects to lose, at a minimum, 2,400 jobs. There are not many alternative sources of income in Lamu and most of these people will be permanently unemployed.

Together, the railway and transmission lines add at least an additional KSh345.9 billion to the cost of the plant.

The approximately 6,000 people who derive their livelihoods from participating in Lamu’s KSh1.5 billion fishing industry will be similarly affected. Most are local fishermen who use hand-crafted fishing boats and equipment to fish close to the shoreline.

The plant’s emissions and effluent, and the leachate from coal ash waste which is to be stored in a flood zone along Manda Bay, will increase the nitrogen content, water temperature, and heavy metals and carcinogens in the bay. This will negatively impact the quantity, quality, and health of fish and shellfish.

As the water in the bay becomes inhospitable for fish, the industry will move farther into the Indian Ocean. Unfortunately, the boats and equipment used by most of the local fishermen are not appropriate for deep ocean fishing. The move to deeper waters also leads to a transformation and consolidation in the industry where larger companies with petroleum-based deep-sea fishing vessels make it noncompetitive for local independent fishermen even if they were to obtain the necessary boats and equipment. In addition, not as many fishermen are needed on the commercial vessels and few locals will be able to retain their jobs. The work requirements on a commercial fishing boat are such that the Chair of the Lamu Beach Management Unit estimates that only 1 per cent of current fishermen will find work on commercial vessels and that 70 per cent of local fishermen will completely lose their livelihoods. The rest of the fishermen are expected to find other, non-fishing, work locally.

Amu Power has falsely led the public to believe that locals who may lose their jobs due to the coal plant will gain employment during its construction and operation. But they are not transparent about who will get these jobs.

If built, the Lamu Coal Plant would be the first in East Africa. This means that, as a country, we do not have the experience and expertise needed to be among the skilled workforce that will get the better-paying jobs. The coal plant’s Environmental and Social Impact Assessment confirms that 1,700 Chinese expatriates will construct the coal plant leaving us with between 300 and 1,300 jobs to allocate to Kenyans during the construction phase of 3.5 years — less than half what was promised, even in a best-case scenario. The jobs allocated to Kenyans are not skilled labour and do not make up for the thousands who will have lost their livelihoods due to the impacts from the plant.

The ESIA states that the plant will employ 400 people once it is operational. It does not disclose how many of these positions will be technical, requiring experience and expertise that we do not yet have, nor how many will be unskilled jobs – such as coal handling, which comes with health risks – given to Kenyans. Even so, 400 jobs over 25 years neither reemploys the number of local fishermen and people in the tourism industry who will have lost their jobs due to the plant, nor reduces current levels of unemployment in the region.

Amu Power has falsely led the public to believe that locals who may lose their jobs due to the coal plant will gain employment during its construction and operation.

The plant will therefore create job opportunities for expatriates at the expense of thousands of fishermen and locals who are dependent on fishing and tourism as a source of employment while creating – at best – 1,700 jobs over a 25-year period and causing approximately 4,200 job losses in the fishing industry and 2,400 in tourism – a net loss of 4,900 Kenyan jobs.

3) Claim: Coal will help Kenya transform into a manufacturing economy

Manufacturing is one pillar of President Kenyatta’s Big Four agenda. The government’s aim is to raise the contribution of manufacturing to GDP from the current for 9.4 per cent of constant-price [inflation-adjusted] GDP to 20 per cent of GDP by 2022. Amu Power has sold the point that coal provides inexpensive baseload power that is required to boost Kenyan manufacturing to achieve President Kenyatta’s goals. Baseload electricity is the electricity that is always available to commercial and residential consumers. Coal plants run 24-7 so historically they have been used for baseload electricity (as have natural gas and diesel turbines). In contrast, wind and solar are considered intermittent sources of electricity because wind does not blow and the sun does not shine 24 hours a day, 365 days a year.

But Amu Power ignored two things: 1) there are less expensive options for baseload power in Kenya and 2) coal-fired electricity will increase the cost of manufacturing in Kenya.

1) There are less expensive options. Amu Power’s claim that Kenya needs coal for its baseload electricity ignores both that coal is more expensive per kilowatt hour than natural gas and wind power and – more significantly for Kenya – that it is cost competitive with geothermal. Kenya has among the highest geothermal potential in the world – 7,000 to 10,000 MW. Unlike wind and solar, geothermal energy is available for electricity generation 24 hours per day, every day of the year. Unlike coal, it is locally available and is not dependent on purchasing fossil-fuel inputs whose costs fluctuate wildly on international markets.

Kenya’s Least Cost Power Development Plan 2017-2037 states that the price of power from geothermal plants is, on average, about a third the cost of electricity from coal: US$10 cents/kWh compared to US$29.5 cents/kWh. Because geothermal (like wind and sunshine) is free, it is less expensive in the long-term than coal-fired electricity (and has none of the environmental impacts of coal which increase the community’s burden of costs for environmental clean-up and healthcare due to increased cases of pulmonary and cardiac diseases).

Unlike coal, geothermal energy is locally available and is not dependent on purchasing fossil-fuel inputs whose costs fluctuate wildly on international markets.

2) Coal-fired electricity will increase the cost of manufacturing in Kenya. Considering more realistic capacity factors and the prices of coal, rail, and transmission lines, the cost of electricity from the Lamu Coal Plant ranges from KSh15 to KSh213/kWh (instead of the KSh2.58/kWh commercial enterprises paid for FCC in January 2021). If the Lamu Coal Plant is built, the price of electricity for industry could be more than ten times higher than what they are currently paying (in January 2021, commercial consumers paid between Ksh14.61 and KSh23.82 per kWh of electricity).

In order to manufacture with such electricity costs, the prices of goods produced in Kenya would also have to increase, rendering Kenyan products uncompetitive locally and undesirable on international markets.

Conclusion

None of the three claims made by Amu Power to convince the government that Kenyans not only need, but will benefit from, a coal plant hold up under examination. Coal-fired electricity from the proposed Lamu Coal Plant will be two to ten times more expensive than from current sources of generation, causing dramatic increases in our electricity bills. The Lamu Coal Plant will create jobs for Chinese expat workers and cause an overall loss of 4,900 Kenyan jobs. The cost of electricity from the Lamu Coal Plant will make manufacturing in Kenya so expensive that not only will the country not deliver on the president’s Big Four Agenda, but Kenyan goods will become non-competitive on local, regional, and international markets.

The poor economics of the Lamu Coal Plant will be disastrous for Kenya’s economy. It will make electricity unaffordable for most Kenyans and will eliminate competitive growth in the manufacturing sector. Furthermore, with the Lamu Coal Plant saddling Kenyans with billions in debt and hundreds of megawatts of expensive excess generation capacity, the Kenyan government will be prevented from investing in sustainable, low-cost, local sources of electricity generation, hampering the country’s economic development for decades.