The public debt burden has dominated economic debate in 2019. Public debt is likely to be even more topical in 2020, both domestically and globally. As at end November 2019, 31 out of 70 countries in the IMF’s roster of low-income countries are listed as either in or at high risk of debt distress. Another 26 are listed as being at moderate risk, leaving only 13 that are still at low risk. Last week, the IMF approved a $2.9b bailout for Ethiopia, one of the high distress risk countries.

I first called out the Jubilee administration’s borrowing binge six years ago. Up until two years ago, the IMF and the World Bank were still giving it the thumbs up. (Very often we forget that these institutions are lenders and therefore conflicted on matters debt.) A few weeks ago Donald Kaberuka, the immediate former president of the African Development Bank (AfDB) and erstwhile Finance Minister of Rwanda, dismissed as “nonsensical” any suggestion that Africa may have over-borrowed:

“The idea that Africa is drowning in debt is nonsensical . . . If we can improve on our own domestic revenue mobilization, if we can improve on our public debt management and if we can improve on our debt management capabilities, the continent is able to take a bit more debt, especially at this time when the markets are looking for yield.”

This is an interesting argument. You may also have heard it from the Jubilee administration—the problem is not too much debt; it is the Kenya Revenue Authority (KRA) that is failing to meet revenue targets.

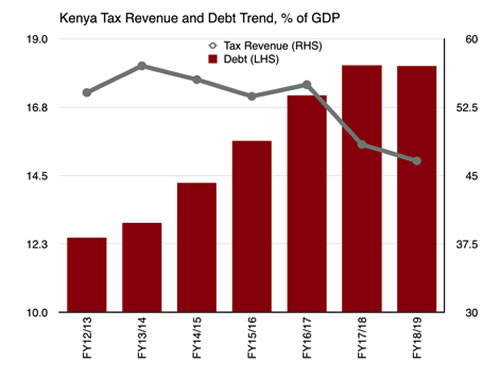

Kaberuka, who I gather is an economist, wittingly or otherwise, fails to make the connection between the borrowing binge and the revenue problem. Only a most incurious economist would look at revenue and debt trends such as ours (see chart) and conclude that they are completely unconnected. Although I have written about the connection on more than one occasion, it is worth recapping. There are two dimensions to the connection: an accounting one and an economic one.

Let’s start with the accounting. Let’s say we start with a GDP of Sh10 trillion which is 80 per cent private economy and 20 per cent government. Let’s then say the government is raising Sh2 trillion, which is 20 per cent of GDP, in tax revenue. Suppose the government goes to China and buys a railway worth Sh500 billion on credit. The GDP will now be Sh10.5 trillion. We will be told that the economy has grown by 5 per cent. But the railway has not added anything to the economy, and nor is it paying tax, so the government still collects Sh2 trillion, but which is now 19 per cent of the Sh10.5 trillion GDP. If this is repeated every year, by year five, the GDP will have expanded to Sh12.8 trillion and the tax revenue-to-GDP ratio will be down to 15.7 per cent.

Let’s start with the accounting. Let’s say we start with a GDP of Sh10 trillion which is 80 per cent private economy and 20 per cent government. Let’s then say the government is raising Sh2 trillion, which is 20 per cent of GDP, in tax revenue. Suppose the government goes to China and buys a railway worth Sh500 billion on credit. The GDP will now be Sh10.5 trillion. We will be told that the economy has grown by 5 per cent. But the railway has not added anything to the economy, and nor is it paying tax, so the government still collects Sh2 trillion, but which is now 19 per cent of the Sh10.5 trillion GDP. If this is repeated every year, by year five, the GDP will have expanded to Sh12.8 trillion and the tax revenue-to-GDP ratio will be down to 15.7 per cent.

This is a purely accounting view, which assumes that government investment is neutral, neither helping nor harming the economy. This is not as far-fetched as it might at first appear. For example, it could simply reflect government investments with long gestation periods. Indeed, we have been told that the new Standard Gauge Railway (SGR) is one such long-term visionary project whose benefits will be realised by our grandchildren. But for no harm to occur, two conditions need to obtain. First, all the borrowing needs to be foreign. Use of domestic resources means diverting these from the private economy, and that is harmful. We call this crowding out. Second, there are no repayments, because repayment of foreign debt amounts to sucking money out of the economy, also harmful. Neither obtains.

Let us start with repayments. This year, we have budgeted to pay Sh139 billion ($1.39 billion) in foreign interest, a tenfold-plus increase from Sh11b ($130m) in the 2012-2013 financial year, the last year of the Grand National Coalition government. And this does not include the hefty payments of the principal on the SGR loans that kicked in this year. The use of domestic resources is also a very significant factor. Half the debt that the Jubilee administration has accumulated is domestic. The crowding out extends beyond credit. With so much money to spend liberally, trading with the government becomes the most profitable business, diverting other economic services away from, and inflating the costs for the private sector. This could not be better demonstrated than by the case of Kenya’s banking industry.

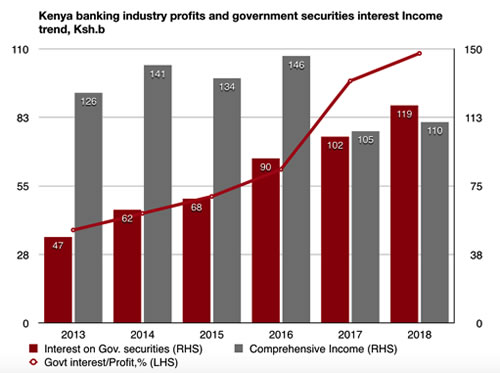

Last year, the industry made a consolidated profit of Sh110b, and Sh119b in interest from government securities. Considering that lending to government is virtually costless and risk-free, this implies that banks made all their profits from the government, and lost Sh9b on the business they did with the rest of the economy. The contribution of interest on government securities has increased steadily from 37 per cent in 2013 to 108 per cent in 2018 (see chart). But we also see that the banks’ profitability has declined. Profits declined by 40 per cent in 2017, following the capping of interest rates in late 2016. In 2018 profits were 14 per cent lower than in 2013. If banks are not making money from the private economy, it stands to reason that government revenue will also take a hit.

Last year, the industry made a consolidated profit of Sh110b, and Sh119b in interest from government securities. Considering that lending to government is virtually costless and risk-free, this implies that banks made all their profits from the government, and lost Sh9b on the business they did with the rest of the economy. The contribution of interest on government securities has increased steadily from 37 per cent in 2013 to 108 per cent in 2018 (see chart). But we also see that the banks’ profitability has declined. Profits declined by 40 per cent in 2017, following the capping of interest rates in late 2016. In 2018 profits were 14 per cent lower than in 2013. If banks are not making money from the private economy, it stands to reason that government revenue will also take a hit.

How much public debt is too much?

Debt experts have sophisticated models that are supposed to tell us. These models are built around “present value.” Present value is the sum of a forecast, such as a cash flow, and in this case annual debt repayments, discounted by a rate of interest or other relevant discount factor, used to give an estimate of current worth. If two similar countries borrow the same amount of money on similar terms, one invests wisely, and the other plunders it all, the net present value of the debt will be the same. It should not surprise then that the IMF’s models were giving the Jubilee borrowing binge the thumbs-up even as the Eurobond went walkabout and one Josephine Kabura was mocking us with tall tales of cash stuffed in gunny bags.

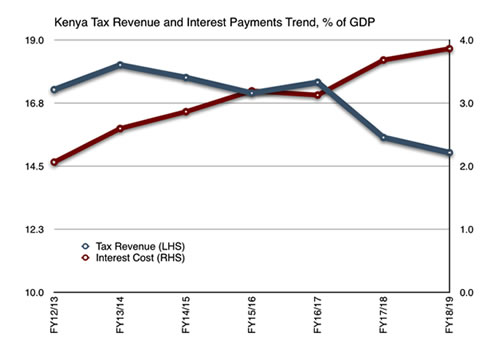

For the financial health of a country, a simple rule of thumb is to ensure that debt service does not grow faster than government revenue for too long. If the debt is invested productively, the investments expand the economy, the government generates more tax revenue from the expanding economy, which it then uses to service the debt. How long is too long? That is a matter of exercising sound judgement. As John Maynard Keynes famously quipped, in the long run, we are all dead. But the question becomes moot when the trend looks like what we see in the chart—debt service heading north, revenue heading south. You do not need present value calculations to see that this trend cannot go on for much longer. Sooner or later, something will have to give.

For the financial health of a country, a simple rule of thumb is to ensure that debt service does not grow faster than government revenue for too long. If the debt is invested productively, the investments expand the economy, the government generates more tax revenue from the expanding economy, which it then uses to service the debt. How long is too long? That is a matter of exercising sound judgement. As John Maynard Keynes famously quipped, in the long run, we are all dead. But the question becomes moot when the trend looks like what we see in the chart—debt service heading north, revenue heading south. You do not need present value calculations to see that this trend cannot go on for much longer. Sooner or later, something will have to give.

Expect to hear a lot about fiscal consolidation in 2020.

Fiscal consolidation is defined as policy measures that aim to reduce the deficit and stop the accumulation of debt. The substance of it is what we used to call structural adjustment but, following the 2007 financial crisis, it became necessary to invent a new name—it just wouldn’t do to speak of Spain, or the UK for that matter, as implementing structural adjustment.

A fiscal consolidation strategy is predicated on the expectation that governments can find ways of bringing down deficits without hurting growth. Budget deficits are, in essence, the pumping of money into the economy, which ought to stimulate growth. Conversely, fiscal consolidation amounts to withdrawing money from the economy, which would dampen growth. The problem is that economic slowdown hurts revenue, meaning that the government has to constrain expenditure even further to meet its deficit reduction targets.

The first strategy entails counteracting the contractionary effect of fiscal consolidation with expansionary monetary policy. Simply put, what the government takes away, the Central Bank puts back in circulation. The Central Bank has a couple of tools to do this, principally by buying bonds and lowering the cash ratio and liquidity requirements for the banks (the percentages of assets that banks are required to have in cash and near-cash assets such as Treasury bills and bonds). Shovelling money out of the door is also expected to reduce interest rates, which besides making borrowing attractive for businesses and consumers, can substantially lower the interest cost of domestic debt. But unlike fiscal stimulus where the government is the spender, monetary stimulus depends on market response. The policy makers hope the money will stimulate production, but it could just as well suck in imports, or leave the country to seek higher returns elsewhere, thereby depleting foreign exchange reserves and putting pressure on the currency.

The second strategy is to find “off-balance sheet” financing of public investment. The default alternative these days is the so-called public-private partnerships (PPPs). Simply put, PPPs are the public equivalent of equity financing. Instead of the government borrowing to build a hospital for instance, a private investor builds, and the government leases it. But PPPs have their drawbacks. First, to make them attractive to private investors, PPP projects are usually structured in such a way as to ensure that the investors cannot lose money—“de-risked” in financial lingo.

Second, PPPs are seldom commercially viable so, more often than not, the Government usually has to part-finance the project in order to achieve an attractive rate of return for investors. Third, PPP financing cherry picks projects with commercialisation potential, which typically will be projects that benefit more developed areas or better-off people in society. In economics, we call such policies “regressive”, meaning they transfer resources from the poor to the rich. Fourth, PPPs have a very high corruption risk—we need look no further than the stink that is the medical equipment leasing scheme known as the Managed Equipment Services (MES) project.

Another scheme is to shift debt and deficit financing from the national government’s books to quasi-government agencies, such as has recently been done by amending the law to allow the Kenya Roads Board (KRB) to issue bonds leveraged on the fuel levy revenues that are earmarked for road construction. Assuming an interest rate of, say, 12 per cent, each shilling of fuel levy revenue can be leveraged to borrow 8 shillings. Already, the KRB has published an expression of interest for transaction advisors to raise Sh150 billion. Suffice it to say that Greece used financial gymnastics of this nature to first be admitted into the Eurozone and to subsequently fake compliance.

PPPs have a very high corruption risk—we need look no further than the stink that is the medical equipment leasing scheme known as the Managed Equipment Services (MES) project

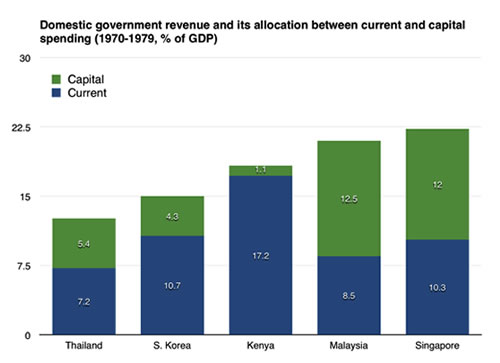

How much public finance does development require? There is perhaps no better place to benchmark than with the Asian Tigers.

In the 70s, Thailand and South Korea were raising 13 and 15 per cent of GDP in tax revenue, well below Kenya’s 18 per cent, while Malaysia and Singapore were doing better at just over 20 per cent (see chart). But where the East Asians stand apart is that each of them was able to put at least a third of their revenue into investment. The real miracle here is how they managed to keep their recurrent budget to a maximum of 10 per cent of GDP, out of which they were also heavily investing in education. As economists Mahbub ul Haq and Khadija Haq observed, beneath the East Asian economic miracle lay an education miracle.

In the 70s, Thailand and South Korea were raising 13 and 15 per cent of GDP in tax revenue, well below Kenya’s 18 per cent, while Malaysia and Singapore were doing better at just over 20 per cent (see chart). But where the East Asians stand apart is that each of them was able to put at least a third of their revenue into investment. The real miracle here is how they managed to keep their recurrent budget to a maximum of 10 per cent of GDP, out of which they were also heavily investing in education. As economists Mahbub ul Haq and Khadija Haq observed, beneath the East Asian economic miracle lay an education miracle.

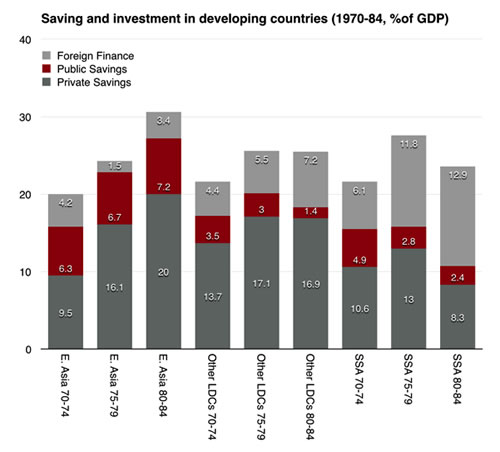

It is also a miracle of public finance, specifically, public thrift. We hear a lot about the high saving and investment rate part of the story. What we do not hear about is the role of government in that story. In the early seventies, East Asian and African countries had similar national savings rates, but even then East Asian governments were contributing more to national saving and investment, although African governments’ contribution was also significant (see chart). A decade later, East Asian governments were still contributing over a third of national investment, while for African and other LDC governments this contribution fell to 11 and 6 per cent respectively. Consequently, we turned to foreign resources. By the early 80s, Africa was investing 20 per cent of GDP more than half of which was foreign-financed, while the East Asians were investing 30 per cent, 90 per cent of which was domestically financed.

It is also a miracle of public finance, specifically, public thrift. We hear a lot about the high saving and investment rate part of the story. What we do not hear about is the role of government in that story. In the early seventies, East Asian and African countries had similar national savings rates, but even then East Asian governments were contributing more to national saving and investment, although African governments’ contribution was also significant (see chart). A decade later, East Asian governments were still contributing over a third of national investment, while for African and other LDC governments this contribution fell to 11 and 6 per cent respectively. Consequently, we turned to foreign resources. By the early 80s, Africa was investing 20 per cent of GDP more than half of which was foreign-financed, while the East Asians were investing 30 per cent, 90 per cent of which was domestically financed.

In the 70s, Thailand and South Korea were raising 13 and 15 per cent of GDP in tax revenue, well below Kenya’s 18 per cent, while Malaysia and Singapore were doing better at just over 20 per cent

The East Asian experience is telling us that when people were too poor to save much, it is the government, and not foreign resources, that closed the gap between private savings and investment requirements. In economics, we postulate that saving is determined primarily by income, and investment by rate of return. As these public investments paid off, they boosted private income and consequently private saving. When countries save more, they need less, not more foreign resources to finance investment. Donald Kaberuka is telling us that we need to raise more revenue to enable us to borrow more. Is he ignorant or dishonest?

During his tenure, the AfDB became the lightning rod for infrastructure-led growth, a fallacy that this column has discussed before. In fact, the nonsensical comments echo sentiments in the AfDB’s 2018 Africa Economic Review, to wit:

“For much of the past two decades, the global economy has been characterised by excess savings in many advanced countries. Those savings could be channeled into financing profitable infrastructure projects in developing regions, especially Africa, to achieve the G20’s industrialisation goal. That this mutually profitable global transaction is not taking place is one of the biggest paradoxes of current times.”

You may want to note that the objective is to “meet the G20’s industrialisation goal.” The irrepressibly prescient Franz Fanon read in the tea leaves:

“The national bourgeoisie will be quite content with the role of the Western bourgeoisie’s business agent, and it will play its part without any complexes in a most dignified manner.”

And therein lies the rub.